Times are tough for marketers right now. So let me take you away to

an oasis of consumer loyalty where huge margins and a ridiculously

dominant market share are the norm. Where private label is non-existent

and your biggest competitor is your second string product. No, it’s not a

fantasy. It’s the alternative marketing universe occupied by Gillette.

Thanks to years of product innovation and heavy investment in marketing and advertising, Gillette occupies perhaps the most dominant position of any of the major global consumer goods brands with an estimated 70% share of the global razor blade category. Common sense might suggest that if you found yourself in this envious position you would sit back and count the billions of dollars in annual revenues that this market share delivers. But Gillette is owned by P&G, and while even the best marketing company in the world can’t improve much beyond that level of market share – there are plenty of other levers to pull to generate shareholder value. And those levers provide brand managers with a vital, best practice lesson in growing a brand’s contribution even when market share remains constant.

Gillette usually practices positive cannibalization. Gillette launched its five bladed Fusion line in 2006 with a 40% price premium over Mach3, its previous three bladed offering. Despite the fact that both lines generate significant profits, with such a huge share of the shaving market it makes more sense for Gillette to focus its marketing resources on switching its own customers from Mach 3 to the more profitable Fusion line than trying to win any more share from competitors. That’s why Gillette is now spending millions to compete against itself with ads and online comparisons that attempt to convince its Mach 3 consumers that their current razor is simply not good enough and to trade up to Fusion. A year ago Fusion started a TV campaign called “Nudging Disciples” in which ads argued that “five is better than three,” referring to the different blade counts of Fusion and Mach3. The spot shows Tiger Woods, Derek Jeter and Roger Federer literally knocking Mach3 razors out of men’s hands with a golf ball, baseball and tennis ball, respectively. “Sometimes you need a little push to let go of your Mach3 razor,” the narrator says. While it may seem crazy to spend millions to compete against yourself, the margin differences mean that this will deliver a better ROI than targeting the small number of remaining non-Gillette consumers over to the brand. Targeting existing customers is usually easier and the conversion rates are better.

Extend the brand! Gillette have a billion dollar brand equity – use it to enter and take control of other related categories. For Gillette that has meant a successful foray into the “software” side of shaving with up to a 50% share in the shaving cream category in many countries and a growing slice of deodorants and shampoos too.

Finally, stay frosty. Today’s market dominator could end up being tomorrow’s has-been brand. The vast majority of spend on consumer goods marketing is spent defensively to maintain share, not grow it. No surprise therefore that Gillette is one of the brands linked to the hottest TV series of 2009 – the second series of True Blood from HBO. Their fictional tie-in campaign shows a vampire endorsing Fusion as the best shave for the undead. It will deliver a huge amount of defensive awareness while keeping the brand contemporary and hip in the never ending battle to stay fresh.

So take some comfort with our shrinking share, puny margins and tiny marketing budget. I think I have it tough? Look how hard Gillette has to work with 70% share, 3000% mark up and no real competition. Who said brand management was ever easy?

It is a very popular brand among the youth. Gillette's new innovations in brand strategy helps the company to improve its brand value day by day.

This means that a big part what it takes to capture and exploit the Early Majority is in place already with brand leadership and millions of satisfied users around the globe.

In it’s current state, you can see that the current product messaging is actually talking to Early Adopters, NOT the Majorities. The marketing question is, is this it for now, or is there more we can do to exploit the new Fusion Pro Glide product?

If we look at positioning best practice, the answer is yes!

Here’s a structural model of how this can work (by segment):

These buyers appreciate and will pay a premium for the leading product in the category, making this is a clear sweet spot for this particular product now.

As mentioned earlier, the key to effective positioning here is connecting the “what’s in it for me?” question in the clearest terms possible that yields maximum results. In this case, Gillette has opted for a “Turn Shaving Into Gliding” message, which begs the question, “What does Gliding mean?” It glides, perhaps, but so what? What does Gliding do for me?

And yet buried deep in the current presentation, there is an answer… all the wonderful product features, YouTube videos, NASCAR endorsements, and Dream Job promotions are designed, perhaps indirectly to support the message that Fusion Pro Glide delivers “Gillette’s most comfortable shave ever.”

That’s what Early Majority buyers looking for. Now we get it! The big benefit, the compelling reason to buy. It was there, but buried by the Gliding message. All we need to do is call this message out front and center. And if you want to be slick about it, again from the current messaging, add… “Guaranteed.”

Roll it all up, here is what’s in it for the Early Majority buyer. Pro Glide Fusion is: Gillette’s most comfortable shave ever. Guaranteed.

As it stands, Gillette has a dizzying array of lower cost blades and razors from earlier category leaders Fusion and Mach 3 to a whole slew of disposables. “Dizzying” is the operative word. Extremely complex.

What we need here is a clear roadmap of products, perhaps broken down into 1. blades and 2. disposables from Good to Better and Pro Glide in the role of BEST… with a blade price of “lowest” to “more” to “most” expensive. Your Choice.

And since Fusion Pro Glides fit in millions of Fusion handles already in the market, it is easy to slip in a free blade and coupon for later purchase in the package to engage these established buyers and get them into the pipeline. We have to assume this is in the works already.

This offers up a value platform with the opportunity to move customers up the ladder from “cheap” to Better and Best products and from a commodity buyer to a premium one. I call this Marketing JuJitsu. Here is where positioning focused on costs per shave and other metrics commodity buyers think about can come into play to demonstrate brand value to the these buyers too.

Example:

Let’s assume we can get two-weeks of shaves out of one Fusion Pro Glide blade. (Note: I have gotten up to four weeks, even with my heavy beard). Two weeks of comfortable shaves at $3 per blade equals approximately $.21 per shave. Let’s assume you can buy a disposable for $.20 per razor that safely delivers a shave, or two. Now the value proposition to this segment can be turned around to something like…

“For just pennies extra a day you can move up to Gillette’s closest, most comfortable shave. Take the challenge to see and feel the difference for yourself. Low(est) cost and most comfort from Gillette… The Best A Man Can Get.”

Here is what the structure looks like all together with above.

As you can see, now we have a Strategic Framework capable of positioning Fusion Pro Glide in multiple segments across the Lifecycle simultaneously under the Best A Man Can Get Brand Platform:

Thanks to years of product innovation and heavy investment in marketing and advertising, Gillette occupies perhaps the most dominant position of any of the major global consumer goods brands with an estimated 70% share of the global razor blade category. Common sense might suggest that if you found yourself in this envious position you would sit back and count the billions of dollars in annual revenues that this market share delivers. But Gillette is owned by P&G, and while even the best marketing company in the world can’t improve much beyond that level of market share – there are plenty of other levers to pull to generate shareholder value. And those levers provide brand managers with a vital, best practice lesson in growing a brand’s contribution even when market share remains constant.

Gillette usually practices positive cannibalization. Gillette launched its five bladed Fusion line in 2006 with a 40% price premium over Mach3, its previous three bladed offering. Despite the fact that both lines generate significant profits, with such a huge share of the shaving market it makes more sense for Gillette to focus its marketing resources on switching its own customers from Mach 3 to the more profitable Fusion line than trying to win any more share from competitors. That’s why Gillette is now spending millions to compete against itself with ads and online comparisons that attempt to convince its Mach 3 consumers that their current razor is simply not good enough and to trade up to Fusion. A year ago Fusion started a TV campaign called “Nudging Disciples” in which ads argued that “five is better than three,” referring to the different blade counts of Fusion and Mach3. The spot shows Tiger Woods, Derek Jeter and Roger Federer literally knocking Mach3 razors out of men’s hands with a golf ball, baseball and tennis ball, respectively. “Sometimes you need a little push to let go of your Mach3 razor,” the narrator says. While it may seem crazy to spend millions to compete against yourself, the margin differences mean that this will deliver a better ROI than targeting the small number of remaining non-Gillette consumers over to the brand. Targeting existing customers is usually easier and the conversion rates are better.

Extend the brand! Gillette have a billion dollar brand equity – use it to enter and take control of other related categories. For Gillette that has meant a successful foray into the “software” side of shaving with up to a 50% share in the shaving cream category in many countries and a growing slice of deodorants and shampoos too.

Finally, stay frosty. Today’s market dominator could end up being tomorrow’s has-been brand. The vast majority of spend on consumer goods marketing is spent defensively to maintain share, not grow it. No surprise therefore that Gillette is one of the brands linked to the hottest TV series of 2009 – the second series of True Blood from HBO. Their fictional tie-in campaign shows a vampire endorsing Fusion as the best shave for the undead. It will deliver a huge amount of defensive awareness while keeping the brand contemporary and hip in the never ending battle to stay fresh.

So take some comfort with our shrinking share, puny margins and tiny marketing budget. I think I have it tough? Look how hard Gillette has to work with 70% share, 3000% mark up and no real competition. Who said brand management was ever easy?

It is a very popular brand among the youth. Gillette's new innovations in brand strategy helps the company to improve its brand value day by day.

- Right from the very beginning Gillette's vision is to establish a brand value by delivering consumer value faster through innovation in customer leadership.

- Gillette did revolutionize the market of shaving razor in 1971 by introducing the twin-blade razor named Trac II.

- Gillette's brand value is increasing by reason of its innovation in branding. It has introduced Fusion through which it is attracting more men to go for the Gillette shave.

- The Proctor & Gamble, who owned the Gillette brand, has introduced some attractive products with its razor through a fusion brand which comprises Fusion Hydra Gel men shaving gel and Hydra Cool aftershave sets.

- Gillette has put up a lot of effort on building their homepage which is very popular. It looks cool and has a nice pale-blue shade which reflects the real power under it.

- In 2005, Gillette claimed the 15th position in the Inter brand's Top 100 Global Brands' list.

- Gillette's brand value was 17,534 million dollars in 2005, while in the previous year 16,723 million dollar

Over

the past two decades, Gillette has been at the forefront of innovation

in the male grooming category, becoming a brand that is synonymous with

shaving. In a bid to retain its brand status, Gillette launched the

Fusion ProGlide razor in June 2010 in an attempt to address men’s

shaving comfort needs.

With research showing that 65% of males still experience shaving discomfort, Gillette decided to extend its Fusion shaving range with the introduction of the ProGlide razor. Its several high-precision innovations together promised reduced “tug and pull” for men during shaving, thereby enhancing both performance and comfort.

The immediate market success of the Fusion ProGlide razor is down, in large part, to Gillette’s shift towards a more consumer-based marketing strategy. With a unique pre-launch marketing campaign and experiential marketing efforts, Gillette has successfully responded to male consumer skepticism surrounding the launch of Fusion ProGlide, allowing the product to speak for itself.

By focusing its marketing efforts on the consumer, Gillette has managed to successfully position the Fusion ProGlide razor across the entire consumer adoption lifecycle. In doing so, Gillette has ensured market growth for the brand moving forwards.

- See more at: http://www.marketline.com/blog/gillette-fusion-proglide-using-consumer-focused-marketing-to-instill-brand-confidence/#sthash.x5KZfYM8.dpuf

With research showing that 65% of males still experience shaving discomfort, Gillette decided to extend its Fusion shaving range with the introduction of the ProGlide razor. Its several high-precision innovations together promised reduced “tug and pull” for men during shaving, thereby enhancing both performance and comfort.

The immediate market success of the Fusion ProGlide razor is down, in large part, to Gillette’s shift towards a more consumer-based marketing strategy. With a unique pre-launch marketing campaign and experiential marketing efforts, Gillette has successfully responded to male consumer skepticism surrounding the launch of Fusion ProGlide, allowing the product to speak for itself.

By focusing its marketing efforts on the consumer, Gillette has managed to successfully position the Fusion ProGlide razor across the entire consumer adoption lifecycle. In doing so, Gillette has ensured market growth for the brand moving forwards.

- See more at: http://www.marketline.com/blog/gillette-fusion-proglide-using-consumer-focused-marketing-to-instill-brand-confidence/#sthash.x5KZfYM8.dpuf

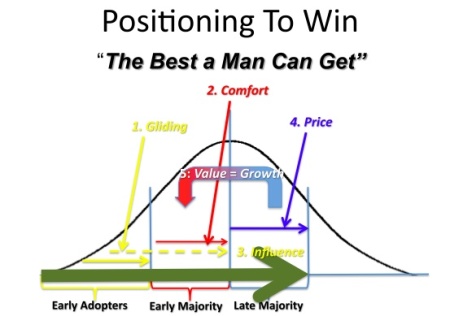

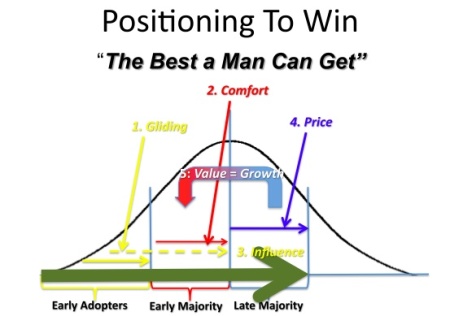

Positioning to Win for Maximum Impact

As we all know, Proctor and Gamble, Gillette’s parent company, is a brand and marketing powerhouse. And Gillette is an established market leader in the razor space and has been so for decades.This means that a big part what it takes to capture and exploit the Early Majority is in place already with brand leadership and millions of satisfied users around the globe.

In it’s current state, you can see that the current product messaging is actually talking to Early Adopters, NOT the Majorities. The marketing question is, is this it for now, or is there more we can do to exploit the new Fusion Pro Glide product?

If we look at positioning best practice, the answer is yes!

Here’s a structural model of how this can work (by segment):

1. Early Majority

A. LeadershipThese buyers appreciate and will pay a premium for the leading product in the category, making this is a clear sweet spot for this particular product now.

As mentioned earlier, the key to effective positioning here is connecting the “what’s in it for me?” question in the clearest terms possible that yields maximum results. In this case, Gillette has opted for a “Turn Shaving Into Gliding” message, which begs the question, “What does Gliding mean?” It glides, perhaps, but so what? What does Gliding do for me?

And yet buried deep in the current presentation, there is an answer… all the wonderful product features, YouTube videos, NASCAR endorsements, and Dream Job promotions are designed, perhaps indirectly to support the message that Fusion Pro Glide delivers “Gillette’s most comfortable shave ever.”

That’s what Early Majority buyers looking for. Now we get it! The big benefit, the compelling reason to buy. It was there, but buried by the Gliding message. All we need to do is call this message out front and center. And if you want to be slick about it, again from the current messaging, add… “Guaranteed.”

Roll it all up, here is what’s in it for the Early Majority buyer. Pro Glide Fusion is: Gillette’s most comfortable shave ever. Guaranteed.

2. Late Majority

Research I found seems to indicate support my Dad’s feelings about shaving. It is a necessary evil, something we have to do due for social conventions, but inconvenient at best. This attitude sets up commodity-style, low-price “just get it over with” thinking.As it stands, Gillette has a dizzying array of lower cost blades and razors from earlier category leaders Fusion and Mach 3 to a whole slew of disposables. “Dizzying” is the operative word. Extremely complex.

What we need here is a clear roadmap of products, perhaps broken down into 1. blades and 2. disposables from Good to Better and Pro Glide in the role of BEST… with a blade price of “lowest” to “more” to “most” expensive. Your Choice.

And since Fusion Pro Glides fit in millions of Fusion handles already in the market, it is easy to slip in a free blade and coupon for later purchase in the package to engage these established buyers and get them into the pipeline. We have to assume this is in the works already.

3. The Best A Man Can Get: Positioned for Growth Across the Lifecycle

If we go back to Gillette’s core brand, we can see we have the platform we need to cut across the whole razor line… “the best a man can get.” I was surprised to see that it is still alive and core… embedded right in the logo treatment itself. As one would expect with a brand of this caliber, it was like seeing an old friend. Powerful indeed.This offers up a value platform with the opportunity to move customers up the ladder from “cheap” to Better and Best products and from a commodity buyer to a premium one. I call this Marketing JuJitsu. Here is where positioning focused on costs per shave and other metrics commodity buyers think about can come into play to demonstrate brand value to the these buyers too.

Example:

Let’s assume we can get two-weeks of shaves out of one Fusion Pro Glide blade. (Note: I have gotten up to four weeks, even with my heavy beard). Two weeks of comfortable shaves at $3 per blade equals approximately $.21 per shave. Let’s assume you can buy a disposable for $.20 per razor that safely delivers a shave, or two. Now the value proposition to this segment can be turned around to something like…

“For just pennies extra a day you can move up to Gillette’s closest, most comfortable shave. Take the challenge to see and feel the difference for yourself. Low(est) cost and most comfort from Gillette… The Best A Man Can Get.”

Here is what the structure looks like all together with above.

As you can see, now we have a Strategic Framework capable of positioning Fusion Pro Glide in multiple segments across the Lifecycle simultaneously under the Best A Man Can Get Brand Platform:

- Early Adopter with Glide

- Early Majority with Comfort

- Convert Early Adopters to Influencers building on incentives and promotions

- Create simple and understandable tiers of lower cost products for Late Majority

- Drive a Cost per Shave Value Message and convert Commodity into Premium buyersOver the past two decades, Gillette has been at the forefront of innovation in the male grooming category, becoming a brand that is synonymous with shaving. In a bid to retain its brand status, Gillette launched the Fusion ProGlide razor in June 2010 in an attempt to address men’s shaving comfort needs.

With research showing that 65% of males still experience shaving discomfort, Gillette decided to extend its Fusion shaving range with the introduction of the ProGlide razor. Its several high-precision innovations together promised reduced “tug and pull” for men during shaving, thereby enhancing both performance and comfort.

The immediate market success of the Fusion ProGlide razor is down, in large part, to Gillette’s shift towards a more consumer-based marketing strategy. With a unique pre-launch marketing campaign and experiential marketing efforts, Gillette has successfully responded to male consumer skepticism surrounding the launch of Fusion ProGlide, allowing the product to speak for itself.

By focusing its marketing efforts on the consumer, Gillette has managed to successfully position the Fusion ProGlide razor across the entire consumer adoption lifecycle. In doing so, Gillette has ensured market growth for the brand moving forwards.

- See more at: http://www.marketline.com/blog/gillette-fusion-proglide-using-consumer-focused-marketing-to-instill-brand-confidence/#sthash.x5KZfYM8.dpuf